CGI News: Income-tax elimination would target benefits to wealthy Iowans

Top 1% would get $5,000 a month, vs. only $122 for middle-income earners

DES MOINES, Iowa – If Iowa were to eliminate the state personal income tax, as Governor Kim Reynolds and key legislators propose, it would not only wipe out about half of state budget revenues, but overwhelmingly benefit the wealthiest Iowans.

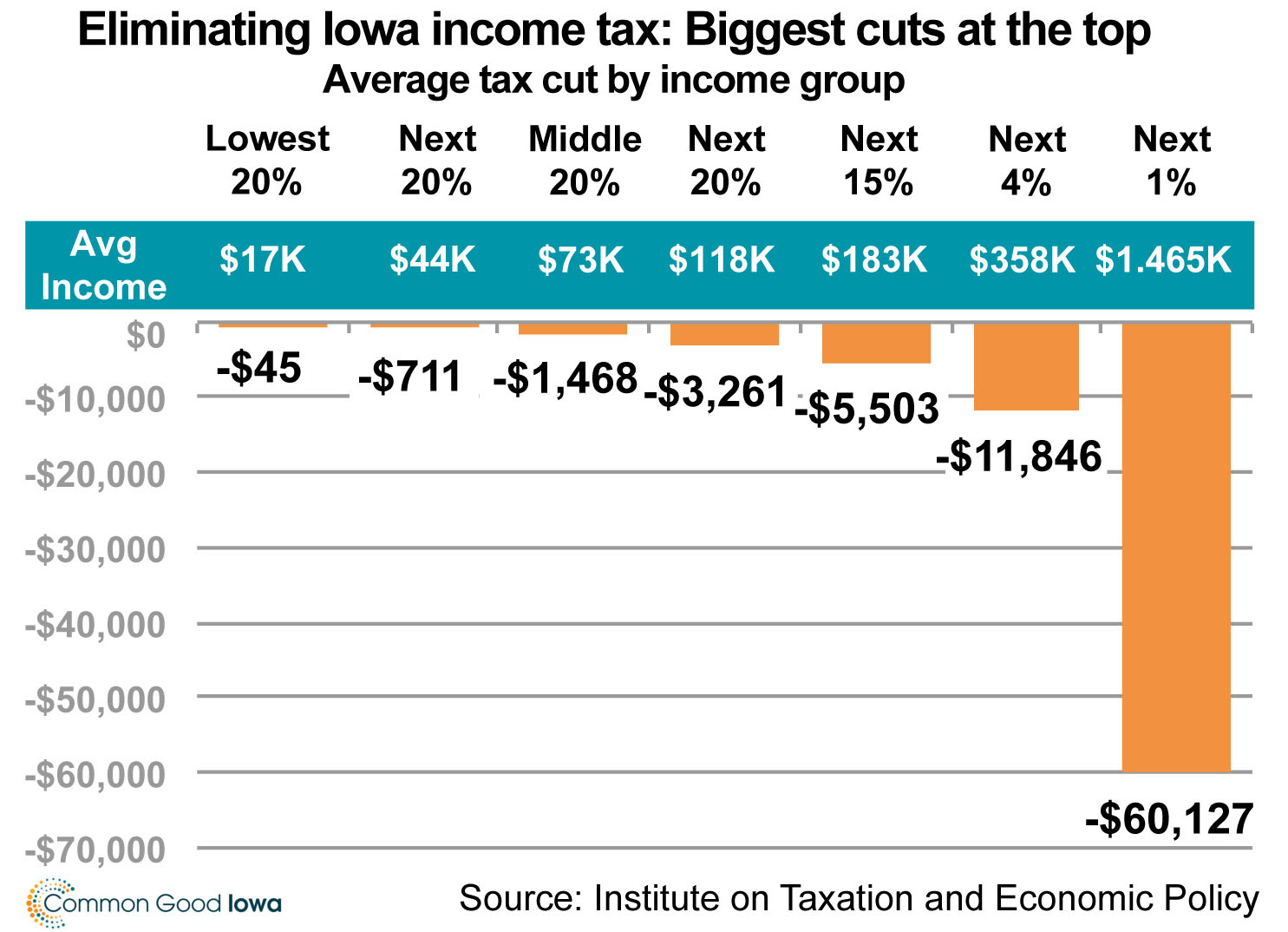

New analysis by the Institute on Taxation and Economic Policy (ITEP) for Common Good Iowa projects an average tax cut of $60,228 for the top 1 percent of Iowa residents by income, compared to a $1,468 average break in the middle group of earners and only $45 in the lowest one-fifth of earners.

“Someone making nearly $1.5 million a year would see a monthly savings of $5,000, while someone in the middle at $73,000 would see just $122. Meanwhile, low-income Iowans would see a benefit of less than $4 a month,” said Anne Discher, executive director of Common Good Iowa, which has opposed further cuts to the income tax.

“We already know the income tax is the only general tax in Iowa based on ability to pay. The ITEP analysis lays out how eliminating the income tax would make our tax system more unfair at the same time it guts revenue for education, health care, child care, clean water and public safety.”

The ITEP analysis found:

-

63.4% of the cut would go to the top 20% of residents by income — people earning over $146,000.

-

92.3% of the top earners would receive a cut, while only 58.1% of earners in the bottom 80% would receive a cut.

-

Cuts are not only concentrated in the top 20%, but even more at the highest levels. While Iowans in the $146,000 to $258,000 income range would average a tax cut of about $6,100, the top 1 percent on average would benefit by about 10 times that amount.

“Although no one would see a tax increase, not everyone would see a cut,” Discher noted. “That’s not something the tax-cut proponents are advertising.”

When lawmakers passed the state’s largest-ever tax cuts in 2022 (House File 2317), they set up a schedule to phase down income-tax rates to 3.9 percent in 2026. The cost was estimated at $1.9 billion by Fiscal Year 2028.

Current plans would go further. While the governor has endorsed income-tax elimination and promised a tax plan for 2024, she has not presented it publicly. State Sen. Dan Dawson has been pushing legislation, SF 552, that would cut the flat rate to 2.5% in 2028 and enable full elimination if money is available in the Taxpayer Relief Fund (TRF). (Also see official Fiscal Note for Senate File 552)

“It’s irresponsible to use one-time funds in the TRF to wipe out tax rates permanently,” Discher said.

ITEP projects that the total tax reduction of personal income tax elimination would be $4.886 billion; that compares to a FY2024 state General Fund budget of $8.512 billion, and revenues of $10.518 billion. Some of the surplus revenues are put in the TRF; some go on to the next budget year and potentially greater surpluses.

Common Good Iowa has produced a short brief on key points about Iowa taxes and the challenges that would come with further tax cuts or income-tax elimination. Find it here: https://www.commongoodiowa.org/media/cms/231218__Fact_sheet_Tax_cuts_whats_a_3DAA20FCFA0EB.pdf

# # # # #

For More Information:

For more information, contact: Mike Owen, Deputy Director, mowen@commongoodiowa.org