Plan messes with resilient unemployment insurance system

Governor's proposed changes undermine long-term solvency of the fund

Iowa’s unemployment insurance (UI) system is among our strongest tools for improving economic well-being for both the worker and the state. It’s also one of the strongest in the nation. When state UI systems across the U.S. floundered in 2021, prompting heavy federal aid, Iowa’s was nowhere close to insolvent.[1]

Iowa’s unemployment insurance (UI) system is among our strongest tools for improving economic well-being for both the worker and the state. It’s also one of the strongest in the nation. When state UI systems across the U.S. floundered in 2021, prompting heavy federal aid, Iowa’s was nowhere close to insolvent.[1]

Governor Reynolds’ proposal in SSB 3038 puts our UI system at risk by severely restricting unemployment trust fund revenue. It puts Iowa on the same track as other states who depend on federal funding to stay afloat.

Iowa’s Unemployment Trust Fund works well now and is sustainable

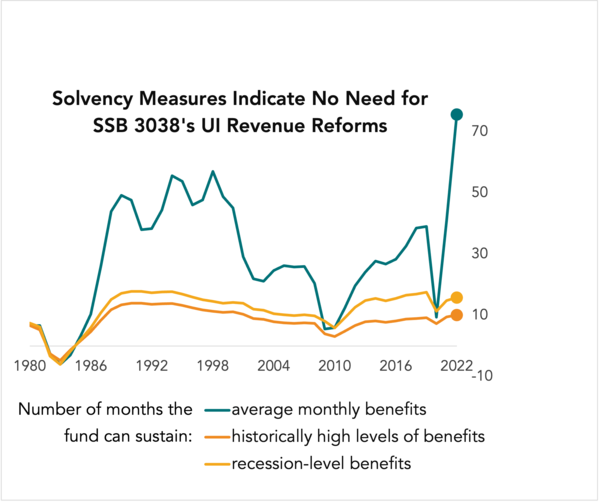

By all measures, the fund is strong and functioning well — it has stayed afloat through decades of rising and falling economic tides. The program’s responsive model allows the fund to bring in the revenue needed to cover benefits as wages and unemployment fluctuate.[2]

Major infusions of one-time federal money during the pandemic boosted the balance of the trust fund, resulting in the higher fund balance we see today.[3] This will naturally decline to normal levels the next time unemployment rises.

![]()

IWD closely tracks fund solve ncy using several measures.[4] Although the fund’s solvency figures are strong, several measures are within standard range, indicating this is not an appropriate time to slash fund revenue. The fund is currently in a healthy position to take on potential economic downturns.

ncy using several measures.[4] Although the fund’s solvency figures are strong, several measures are within standard range, indicating this is not an appropriate time to slash fund revenue. The fund is currently in a healthy position to take on potential economic downturns.

How is revenue for unemployment insurance generated?

Most Unemployment Trust Fund revenue comes from taxes paid by employers.[5] The tax rate employers pay to the state depends primarily on how much their former employees have used UI benefits recently. Businesses with low usage pay very low rates; the average rate in 2022 was 0.6%.[6] This rate is paid on up to $38,200 of wages per employee.[7] That dollar amount, called the “taxable wage base,” is set annually as two-thirds of last year’s average annual wage.[8] See the example business below.

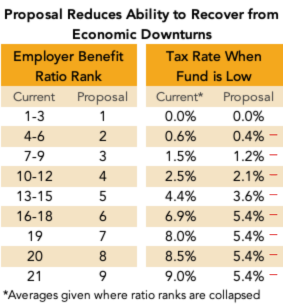

Governor Reynolds' plan, SSB 3083, would cut employer contributions regardless of fund health

The proposed change would cut the taxable wage base in half.[9] The tax rate would apply to only one-third of the average annual wage ($19,100), rather than two-thirds ($38,200). The proposal restructures the tax tables by reducing the number of possible contribution tables and benefit ratio ranks. It cuts the tables’ top tax rate from 7-9% to 5.4%, regardless of fund health.

SSB 3038 is a long-term reform based on the short-term circumstance of having a high fund balance. By restricting revenue in this way, the overall trust fund balance will begin to fall and will then struggle to recover during the next recession. If this were to occur, the UI system may either falter or become reliant upon the federal government for support. Lawmakers should scrap this plan and focus instead on getting farm workers and home care workers the freedom to participate in the unemployment insurance system.

Sean Finn is a policy analyst at Common Good Iowa. Contact Sean at sfinn@commongoodiowa.org.