Fact sheet: Why slashing the income tax is wrong for Iowa

Extremist tax plans at the Capitol would further rig the system against working Iowans

February 2024 | PDF

Tax-cut legislation passed in 2022 and now being implemented poses enormous threats to education, health care and other services Iowans expect. It does so by phasing in a flat rate of 3.9% in 2026, sharply reducing revenues and increasing inequities in state and local taxes.

New legislative proposals would compound the damage. Proposals by Governor Kim Reynolds and legislative leaders would cut both the personal and corporate income tax deeper and faster than current law. The governor’s plan would take the personal income tax down to a flat rate of 3.5% by 2025. The Senate’s plan would take it down by 3.65% by 2027 then use one-time dollars set aside for tax cuts to eventually ratchet down the rate to zero.

Tax cuts threaten schools, health and quality of life

-

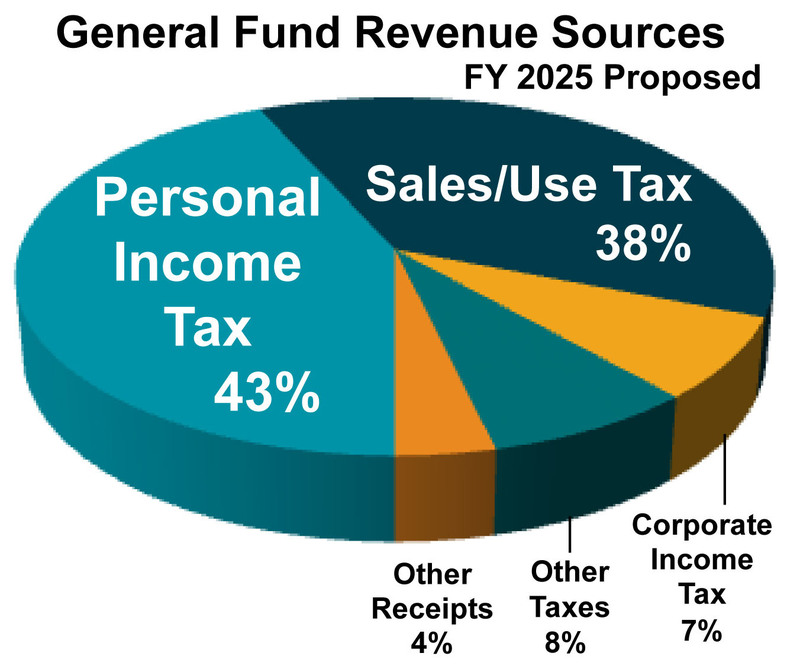

The personal income tax is how we join to lay foundations that create opportunity for Iowans to thrive. Half of General Fund budget revenue in FY 2023, it is the largest revenue source.[1] Implemented as a property-tax relief measure in 1934, the personal income tax is the primary alternative to sales taxes in funding state services. It would take a sales tax of about 15% to make up for losing the income tax.

The personal income tax is how we join to lay foundations that create opportunity for Iowans to thrive. Half of General Fund budget revenue in FY 2023, it is the largest revenue source.[1] Implemented as a property-tax relief measure in 1934, the personal income tax is the primary alternative to sales taxes in funding state services. It would take a sales tax of about 15% to make up for losing the income tax. -

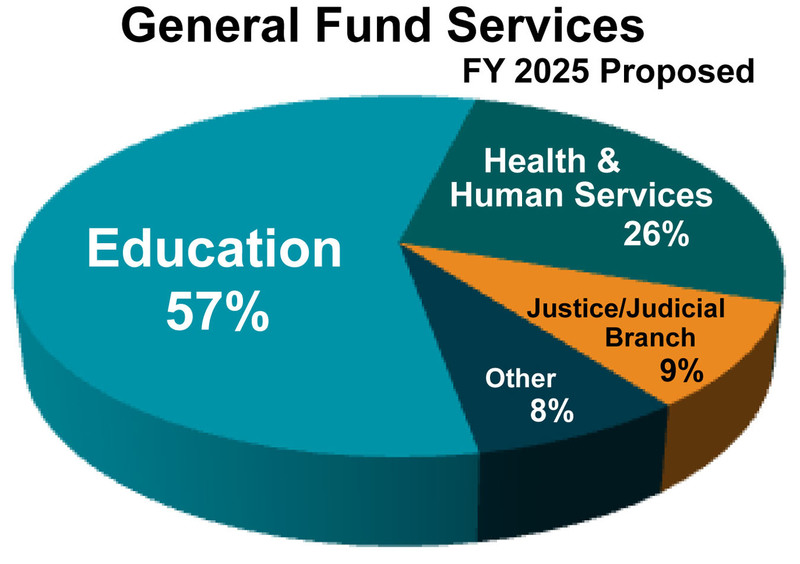

Eliminating the income tax will break the state budget, with devastating effects on services. Over half of the state budget goes toward education. Another quarter goes to health and human services — mainly health care. The balance includes initiatives for clean air and water, a fair and efficient judicial system, public safety and state parks.Would you cut up to 50% of the budget to pay for income-tax cuts tilted to the rich? If so, how?

Eliminating the income tax will break the state budget, with devastating effects on services. Over half of the state budget goes toward education. Another quarter goes to health and human services — mainly health care. The balance includes initiatives for clean air and water, a fair and efficient judicial system, public safety and state parks.Would you cut up to 50% of the budget to pay for income-tax cuts tilted to the rich? If so, how?

Income tax cuts: Windfall for the wealthy rigs our tax system against working families

-

When fully phased in in 2026, almost half of the benefit of the 2022 tax cuts will go to the richest 5% of taxpayers.[2]

-

The Governor’s plan gives two-thirds of the benefit to the highest-income 20%, and over one-third to the top 5%.[3] The Department of Revenue estimates a $30,400 benefit on average to millionaires, 900 times the $34 average to people making under $20,000.

-

The Senate plan to eliminate the income tax would provide a benefit of $60,127 to the top 1%, but only $45 — less than a dollar a week — to the lowest-income 20%.[4]

Implementing a flat income-tax rate makes our tax system more unfair

-

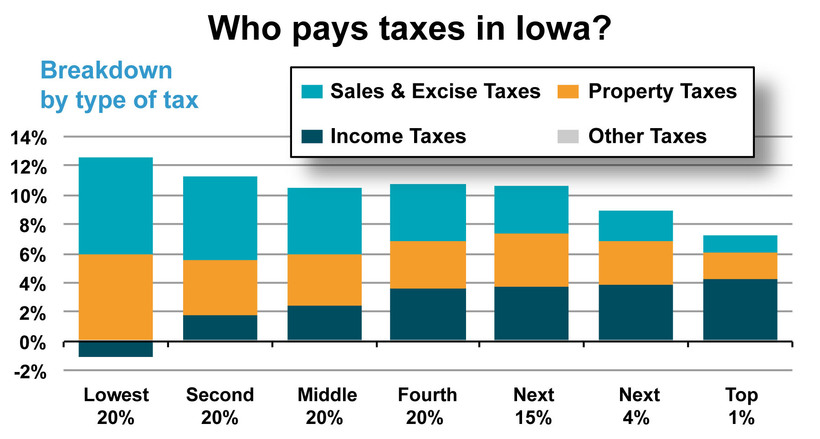

Already, Iowans at high incomes pay lower overall tax rates than people living paycheck to paycheck. Unlike sales and property taxes, the income tax is based on ability to pay.

-

Perversely, a flat rate income tax actually makes Iowa’s state-and-local tax system less flat. The graph shows the income tax — the dark part of the bars — is the only part of Iowa’s tax system where higher-income people pay a higher effective rate.

Perversely, a flat rate income tax actually makes Iowa’s state-and-local tax system less flat. The graph shows the income tax — the dark part of the bars — is the only part of Iowa’s tax system where higher-income people pay a higher effective rate. -

The wealthy should pay their fair share, and only will with a robust and progressive income tax.

Severe budget cuts are inevitable with tax-cutters’ plans

-

Cuts implemented since 2018 already show a $1.7 billion cost in revenue.[5] The budget impact so far is not apparent because of current strong surpluses, driven by federal recovery initiatives that have boosted the economy and state revenues. While the federal aid is not permanent, the tax cuts remain unless offset by other revenue. Already, the Governor’s budget projects a $973 million surplus in 2025, down from $1.8 billion this year. Her budget assumes her tax cuts will pass, but not spur growth to cover the revenue loss.

-

Governor Reynolds’ budget anticipates $4.96 billion in revenue from the personal income tax for the coming fiscal year. While her plan does not include income-tax elimination as the Senate plan does, she has supported the concept as recently as last year. There is no way to cut the budget she has proposed — $8.9 billion — by substantially reducing or eliminating the income tax and not harm PK-12 school sizes, course offerings, college tuition, environmental quality, safety-net services, and public and workplace safety. The math just doesn’t work.

Common Good Iowa is a nonpartisan, nonprofit organization that uses research and advocacy to leverage reliable data, solid analysis and collaborative relationships to craft people-centered policy solutions for Iowa’s most pressing issues. Visit CGI at commongoodiowa.org