Policy Brief: Both Governor's, Senate plans worsen tax inequities

Costly tax cuts would be deeper and faster, and further benefit wealthy

PDF (4 pages) | February 2024

Iowans have traditionally valued expanding opportunity, caring for neighbors and a strong sense of fair play. Tax-cut proposals at the Iowa Statehouse from Governor Kim Reynolds and legislative leaders turn these Iowa values upside down.

They would drastically restrict revenue needed to fund critical services such as education, health care, public safety and environmental quality. The Senate bill, SSB 3141, would set out to fully eliminate the income tax, which until recently has funded roughly half of the state budget. By targeting benefits to the wealthiest Iowans, the plans would throw an already inequitable tax system further out of balance.

And, for good measure, Senate leaders would pair their tax plan with a democracy-killing resolution for a constitutional amendment requiring two-thirds majorities for any income-tax increase. For even marginally controversial legislation, this is a virtually insurmountable hurdle. Tax cuts made by a simple majority vote could not be reversed even decades later without two-thirds approval. SSB 3142 would permit 17 members of the Senate to block action on a tax increase, even if voters, 133 other elected House and Senate members and a Governor decide it is needed to restore lost services.

Iowa’s current system is upside-down

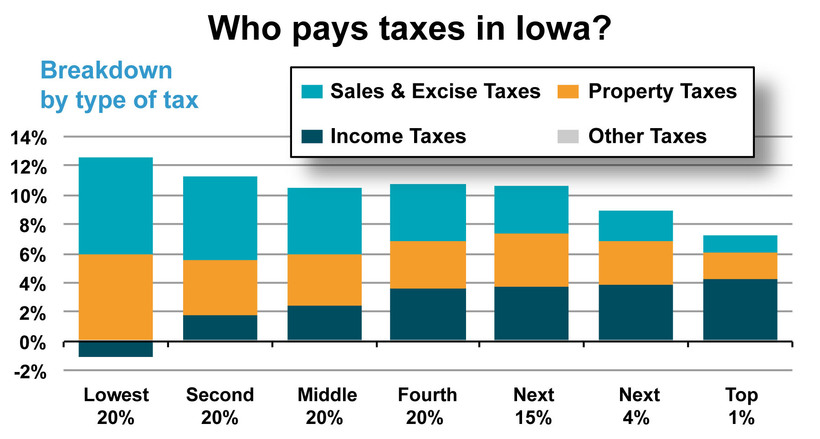

As shown by the latest Who Pays? Report,[1] released in January by the Institute on Taxation and Economic Policy (ITEP), low-, moderate- and middle-income Iowans continue to pay a greater share of their income in state and local taxes than those at high incomes. This longtime pattern is driven by the regressive nature of sales and property taxes, which was only partially offset by an income tax that since its implementation in 1934 has been progressive, setting higher rates at higher incomes.[2]

Under current law, passed in 2022, the top rates in Iowa’s mildly progressive income-tax system are being stripped away each year, arriving at a flat rate of 3.9% on taxable income in 2026. This year, three tax brackets remain in place — 5.7% for income above $62,100, 4.82% for income between $12,420 and $62,100, and 4.4% for income at $12,420 and below.[3]

Governor’s plan: About a 900-to-1 benefit to the rich vs. low-income Iowans

Governor Reynolds would cut deeper and faster, going immediately to a flat rate of 3.65% in 2024 (retroactive to Jan. 1), and to 3.5% in 2025.[4] While there is not yet an official fiscal note on the Governor’s plan, ITEP has estimated the revenue loss at $1.7 billion in tax year 2024 and $1.8 billion in 2025. Her plan would slash the state’s surplus almost in half in FY 2025.

Large surpluses in the budget — driven by higher revenues in an economy that was boosted by federal recovery dollars and is doing well — can temporarily disguise the certain damage of tax cuts. But when the federal support runs out and the tax cuts are fully phased in, the damage will become apparent, especially when the economy declines at some point in the future.

Revenue lost to tax cuts are dollars no longer available for PK-12 schools, for higher education, health care, child care, public safety or environmental quality.

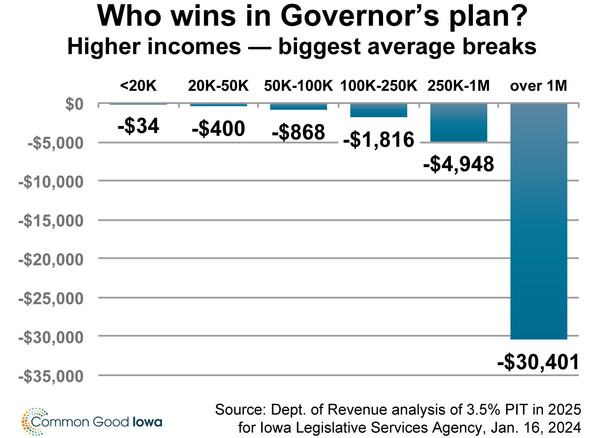

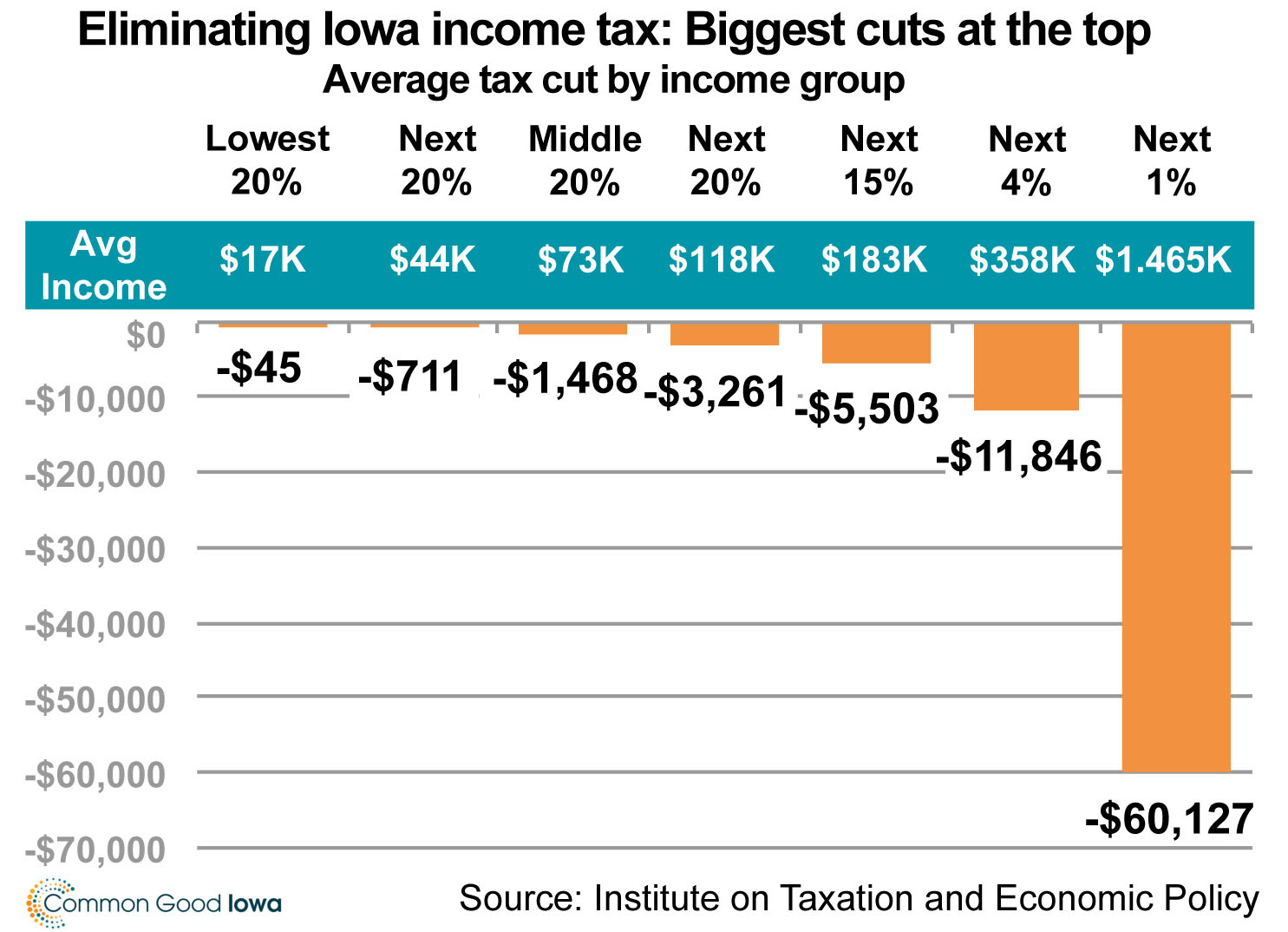

ITEP analysis also shows that the wealthiest would benefit the most from the Governor’s plan. People in the top 20% of incomes would take two-thirds of the benefit. Even among the top 20% there’s a disparity, with those in the top 1%, making an average of $1.5 million year, taking the biggest benefits. Iowa Department of Revenue estimates similar results, an average benefit for millionaires of $30,401 and average for Iowans earning below $20,000 of $34.

Put another way, low-income Iowans would get a break worth less than a tank of gas. Millionaires? They would get a break big enough to buy a new car for their fleet.

Senate plan: Slower start to a crash landing

The new plan from Sen. Dan Dawson (R-Council Bluffs), Senate Ways and Means chair, doesn’t drop the flat rate as quickly as the Governor, except at lower incomes. Instead of stripping away top rates first as in current law, it would move to the currently scheduled lower rates faster at low incomes, then go to 3.775% in 2026 (compared to the current 3.9% and the Governor’s 3.5%), and to 3.65% in 2027. While there is no official fiscal note yet to outline the exact cost, we can already see that the cuts are deeper and are implemented more quickly than current law, which reach $1.9 billion a year in FY 2028 compared with the baseline year of 2022.[5]

Beyond that, the bill sets up a complex process to eliminate the income tax. The Revenue Estimating Conference estimates the individual income tax alone will bring in nearly $5 billion in FY 2025. Even without the official fiscal note, the bottom line is that nothing in the bill covers that kind of annual loss of revenue, so it’s paving a road to a cliff and a crash landing for services that Iowans value. The phased-in impact of the Senate plan also would shower benefits on the wealthy while devastating services.

A better approach: Target surpluses to one-time projects and pilots

The state showed a $1.83 billion surplus in FY 2023 and expects a $1.8 billion surplus in FY 2024, not taking into account any additional tax cuts. The Taxpayer Relief Fund (TRF), expected to rise from $2.74 billion in FY 2023 to $3.68 billion this year, would reach $3.86 billion next year.[6]

Instead of banking surpluses and dumping some of it into the growing TRF to permanently reduce income-tax rates (as Sen. Dawson’s bill does), better approaches exist. Three targeted tax-cut proposals could be implemented as time-limited pilot projects that lawmakers could re-evaluate five-to-10 years out, and they would not cost the state General Fund a dime if paid for by the Taxpayer Relief Fund:

-

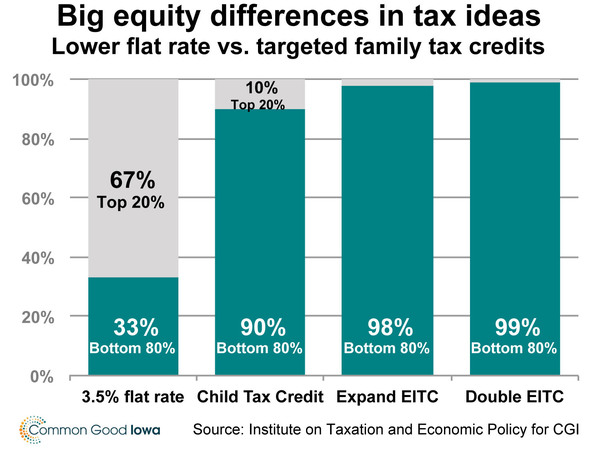

Establish a state Child Tax Credit, as 14 other states including Minnesota have done. The credit in this scenario would be $600 per child for families below $25,000 income, scaling down to a $100 credit at income between $100,000 and $250,000, then phasing out.

-

Expand the state Earned Income Tax Credit (EITC) to include childless adults.

-

Double the state EITC from 15% of the federal EITC to 30%.

Two of these are updates to the state EITC, which helps low- to moderate-income working families with children and was expanded previously with bipartisan support in the Culver and Branstad administrations.

As time-limited projects, all three proposals would be appropriate uses of the one-time dollars in the Taxpayer Relief Fund, offering a far more fiscally responsible approach than any general income-tax cuts that will pose long-term threats to General Fund services. All three would be far less expensive than the income-tax cuts proposed by the Governor or Senate.[7]

And all three focus their benefits on people who’ve gained the least from tax cuts passed in recent years. As shown above, 67% of the benefit of the Governor’s proposed income-tax cut, moving to a 3.5% flat-rate income tax, would go to the top 20% of taxpayers. By contrast, boosting tax credits for families and low-wage workers would overwhelmingly benefit people in the bottom 80%.

Iowa has options for responsible tax policy that sustain our state’s longtime commitments to opportunity and services that make this a good place to live, work, raise a family and run a business. The Governor’s bill and Senate bill both fail this test.

[1] Institute on Taxation and Economic Policy, “Who Pays? 7th Edition,” January 2024. https://itep.org/whopays-7th-edition/

[2] Iowa Legislative Services Agency, “Fiscal Topics: Iowa Income Tax,” January 2014. https://www.legis.iowa.gov/docs/publications/FTNO/24495.pdf

[3] Iowa Department of Revenue. https://tax.iowa.gov/idr-announces-2024-individual-income-tax-brackets-and-interest-rates

[4] Governor Kim Reynolds’ website, “Cutting Taxes for Iowans,” https://governor.iowa.gov/vision-iowa-0/cutting-taxes-iowans

[5] Legislative Services Agency, Final Fiscal Note for HF 2317, (Figure 2, page 9), June 23, 2022. https://www.legis.iowa.gov/docs/publications/FN/1292087.pdf

[6] Governor’s Condition of the State and “Vision for Iowa” budget book, p. 69 (surpluses) and p. 71 (TRF), January 2024. https://dom.iowa.gov/sites/default/files/2024-01/GOV-BIB-Report-FY2025.pdf

[7] ITEP projects the annual CTC cost at $195 million, doubling EITC at $79 million and the childless adult expansion at $2 million.