Why tax cuts won’t change seniors’ decisions to move or stay

February 16, 2022 | by Peter Fisher

Download a PDF

People do not move from state to state over tax policy, research has consistently shown. This is true for the elderly or for people of all ages. While those pushing a tax-cut agenda use the contrary argument to make their case, it is good to take a step back and look at the research.

Karen Conway, professor in the Carsey School of Public Policy at the University of New Hampshire, has been researching elderly migration patterns for decades. “Put simply,” she wrote, “state tax policies toward the elderly have changed substantially while elderly migration patterns have not. ... Our results, as well as the consistently low rate of elderly interstate migration, should give pause to those who justify offering state tax breaks to the elderly as an effective way to attract and retain the elderly.”

“Our results are overwhelming in their failure to reveal any consistent effect of state tax policies on elderly migration across state lines.”[1]

Conway summarized these findings in her most recent report this way: “Census data show that elderly migration is a fairly rare event, with a pattern of movement that has remained stable for decades, despite many new tax breaks designed to attract the elderly. Our formal analyses likewise provide no consistent evidence that these tax breaks influence migration decisions in a meaningful way.”[2]

Iowa’s elderly migration patterns are like those in other states, according to the most recent U.S. Census data: Only about 1 percent of seniors leave the state in a given year, and a slightly smaller number of seniors move into the state — about eight-tenths of 1% of current seniors lived elsewhere last year. As a result, the net outmigration of the elderly from Iowa has averaged fewer than 400 people per year, only two-tenths of 1% of the senior population. Tax exemption of pension income to slow outmigration is clearly enormously expensive; the breaks come at a cost of $400 million a year, which amounts to $1 million for every net out-migrant, most of whom in all likelihood are moving for the weather.

If the revenue loss to the state were not enough to give legislators pause, they should note why taxes don’t matter to most seniors:

-

Many would see no benefit.

-

Those who do would not see enough of a benefit to change their residence.

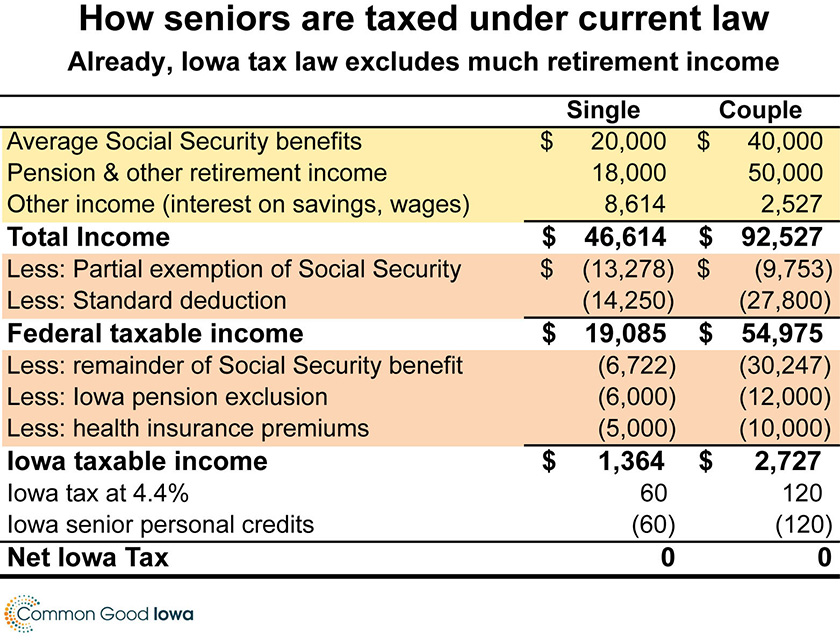

The tax breaks already in the law leave the majority of seniors paying little or no income tax. In the examples here, a single person and a married couple earn an average Social Security benefit (completely exempt in Iowa) and a typical pension income (partially exempt). They have average health insurance expenses for those on Medicare, also deductible. The table shows how much they could earn and still pay no Iowa income tax under current law for tax year 2023.[3] For the couple, $92,527 income is reduced to just $2,727 in Iowa taxable income, leaving them with zero tax after taking the personal exemption credits.

Second, the benefit at any income — but especially in the middle — is too small to make a difference on residency decisions. Analysis by the Institute on Taxation and Economic Policy illustrates this clearly: A household at a middle income — averaging $61,000 — would receive an average benefit of about $600 from the retirement income breaks. That is simply not enough to keep someone from moving now if they were so inclined. And a recent Department of Revenue analysis showed that only 2% of taxpayers with income under $50,000 would get any benefit. For those with $50,000 to $100,000 income, 14 percent get a benefit, but it averages just $833. Seventy-six percent of taxpayers have income under $100,000.[4]

In short, the claims of a benefit to Iowa from the new retirement income breaks have no foundation. They are costly and they would further squeeze General Fund revenues, ratcheting down Iowa’s capacity to provide education, public safety and human services that benefit every Iowan, including retirees.

[1] Karen Conway and Jonathan Rork, “No Country for Old Men (Or Women): Do State Tax Policies Drive Away the Elderly?” National Tax Journal, Vol. 65, No. 2, June 2012.

[2] Karen Conway. “Senior Tax Breaks on the Move—but Are Seniors Actually Moving?” Carsey School of Public Policy, National Issue Brief #120, Spring 2017.

[3] Under current law, Iowa income taxes starting next year will begin with federal taxable income. That means the starting point includes the federal standard deduction. From federal taxable income seniors can deduct three special Iowa tax preferences: the exclusion of all social security benefits, the deduction of the first $6,000 in retirement income ($12,000 per couple), and the deduction of health insurance premiums for those age 65 and older with total income under $100,000. We assume the minimum Medicare part A and B premiums for 2022, the most popular medigap or supplement policy, and a low-cost prescription drug plan.

[4] Letter relating to HSB551/SSB3044 from Mandy Jia, Iowa Department of Revenue, to Jeff Robinson, Legislative Services Agency, February 14, 2022. The tables provided in that letter report Iowa taxpayers by federal adjusted gross income bracket, which measures total income rather than Iowa taxable income. The latter incorporates federal and Iowa deductions and exclusions and thus is a poor measure of household income.