Protecting Iowa taxes protects every Iowan

For a quarter of a century, Iowa lawmakers have been chopping away at the state income tax, giving the biggest tax breaks to the wealthiest Iowa at the expense of all. The most recent — and biggest — hit came in 2022, when lawmakers approved tax breaks that will ultimately cut the state budget by 20%. Key legislators and Gov. Reynolds have said their goal is to fully eliminate the personal income tax that currently pays for half of all services.

Cutting taxes, and in turn the budget, precludes making the investments that make Iowa a better place to live, work, raise a family and do business. And our needs are great:

-

One in 7 families with a full-time worker do not earn enough to get by on their own.

-

One in 7 workers have employers who steal their wages,[1] a crime rarely investigated, much less penalized.

-

Our air and water are dirty, and polluters rarely punished.[2]

-

Schools, nursing homes and hospitals are stretched, and teaching[3] and nursing[4] are becoming less attractive professions.

-

Quality, affordable child care is hard to find.[5]

Giving up income-tax revenue and refusing to adequately address these issues has not made life better for most Iowans. More tax cuts will not produce a different result.

State services: Can’t live without them

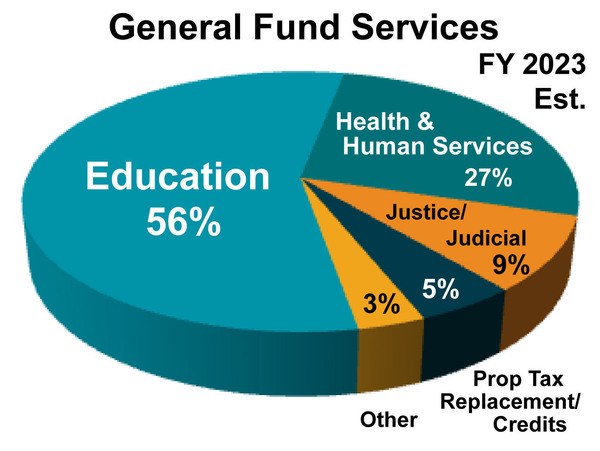

Even a quick look at the budget shows the stakes facing every Iowan, no matter their income, race, gender, occupation or ZIP code.

Even a quick look at the budget shows the stakes facing every Iowan, no matter their income, race, gender, occupation or ZIP code.

-

More than half of the budget goes to education, PK-12 and post-high school, both public and private.

-

A quarter of the budget goes to health and human services, especially Medicaid, which is a lifeline for low-income families, insuring 2 of 5 children and half of all nursing home residents.

-

State dollars are essential to our state’s Child Care Assistance program, which is key to helping many lower-wage families get and keep a job and build their careers.

-

Public safety is a function of both the state and local governments, and the state budget funds court operations and corrections throughout Iowa.

-

Environmental quality cannot be monitored, nor rules enforced, without state funding.

Either directly or indirectly, every Iowan is affected when those concerns are shortchanged by a state budget that does not keep up with need and demand. Tax cuts limit revenue and cause shortfalls in resources necessary for important services that will not be provided in the private sector. Even where the governor and her allied legislators have now decided Iowa should direct public money – to religious school systems – tax revenue is necessary to pay the bill. Less revenue will put pressure on all education, or on other services funded by the state, or some combination. These are the kind of future budget discussions ahead that voucher and tax-cut proponents refused to engage in 2023.

Tax-cutters target the income tax, Iowa’s largest and fairest source of revenue

When lawmakers in 2022 passed the latest round of tax cuts, phasing out a multi-bracket system to what will become a flat-rate income tax of 3.9 percent in 2026, the income tax was half of the state budget. When phased in, these cuts will reduce overall General Fund revenues by at least 20 percent, according to the nonpartisan Legislative Services Agency.[6] Further, because the cuts are phased in, Iowans have barely begun to see the impacts of the full 2022 package, which LSA says will cost $561 million this fiscal year but reach $1.9 billion in Fiscal Year 2028. The impacts, then, will not be fully apparent when voters go to the polls in 2024 or even 2026.

Keeping income tax is essential to sustainable, equitable public policy in Iowa

Across the country, state and local tax systems are mostly regressive – upside down – as they demand more as a percentage of income from low-income taxpayers than from high-income taxpayers.[7] This is a recipe for unfairness in taxes. In Iowa, this fairness issue[8] is compounded by the fact that the income tax, which has been the only progressive part of the Iowa tax system, also is the largest single source of revenue for the state General Fund budget. The income tax also is the only source of state revenue based on ability to pay. When Iowa lawmakers attack the income tax, they make it harder to fund services that all Iowans depend on, and less fair for those who pay the bills.

For more information, contact Mike Owen at mowen@commongoodiowa.org.