Folly of a 'flat' tax

Posted on April 17, 2024 at 5:48 PM by Mike Owen

Truth in advertising: ‘Flat tax’ boosts only the wealthy

A proposed constitutional amendment, SJR 2004, would enshrine inequity in Iowa’s state and local tax system by barring lawmakers from setting income tax rates based on people’s ability to pay. This would require low- and middle-income working Iowans to pay the same tax rate as millionaires to pay for our shared responsibilities.

Its labeling is dishonest, and so is the pretense that sending it to a vote gives voters their say. It restricts that voice only to voters in one election — not to voters in the future.

-

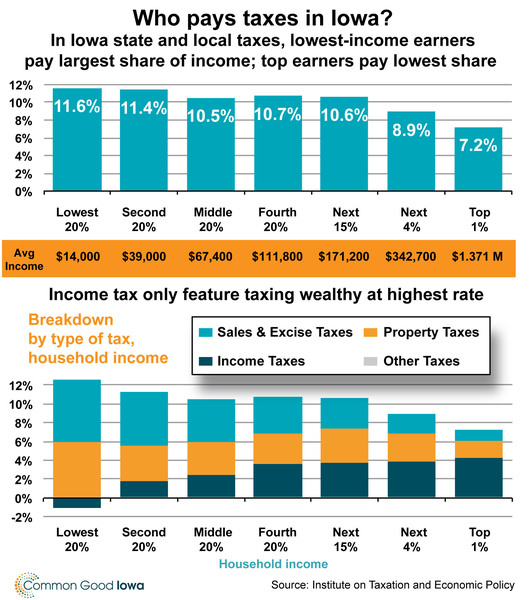

Despite its name, a flat-rate income tax will make Iowa’s overall system less flat. Low-income Iowans already pay a higher share of their incomes in total state and local taxes than do their higher-income neighbors (top graph). Cutting down the income tax — which has been our only tax based on ability to pay — to a flat rate makes that imbalance even worse. The bottom graph shows the impact of the income tax at various income levels; making it a flat rate would tilt the overall system further in favor of the highest earners.

Despite its name, a flat-rate income tax will make Iowa’s overall system less flat. Low-income Iowans already pay a higher share of their incomes in total state and local taxes than do their higher-income neighbors (top graph). Cutting down the income tax — which has been our only tax based on ability to pay — to a flat rate makes that imbalance even worse. The bottom graph shows the impact of the income tax at various income levels; making it a flat rate would tilt the overall system further in favor of the highest earners. -

Setting a flat-rate tax in the constitution permanently compounds these inequities. When middle- and low-income Iowans see in practice how this plan favors the wealthy at their expense while gutting services important to all, it will be too late.

-

A flat-rate tax does nothing for simplicity. Complexities in the determination of taxable income are not changed by the rate. Calculating taxable income is the ballgame – not just the rate. Some of the wealthiest earners receive their income in capital gains. Some get it in retirement income, which we now exempt. Income can be sheltered from tax, which means income from those sources is not treated the same as earned income from hourly or salaried jobs or business profits.

-

States with the least equitable systems are those with a flat-rate income tax or no income tax at all. The Institute on Taxation and Economic Policy (ITEP) has identified the worst 10 state systems for tax fairness.[1] Six of the bottom eight have no income tax — WA, NV, SD, FL, TX and TN. The other two have flat-rate income taxes — IL and PA.

-

A flat-rate income tax forces major cuts in income-tax revenue, blowing a hole in the budget for K-12 education, colleges and universities, health care, child care, workplace protection, public safety and water quality.

Seeking fairness in tax policy

We can make a tax system that treats low- and middle-income Iowans at least as well as the wealthy, who pay less in tax as a share of their income than other Iowans and do not need new breaks. Instead:

-

Expand the Earned Income Tax Credit

-

Create a substantial Child Tax Credit

-

Don’t make any new cuts in general income-tax rates before seeing the impact of the latest changes.

For more information about Iowa tax issues, visit commongoodiowa.org or contact Mike Owen, deputy director of Common Good Iowa, at mowen@commongoodiowa.org.

Categories: Budget & taxes