Speeding faster to the bottom

Posted on May 9, 2024 at 10:27 AM by Mike Owen

The old saying is "a billion here, a billion there, and pretty soon you're talking about real money."

So how about $2 billion?

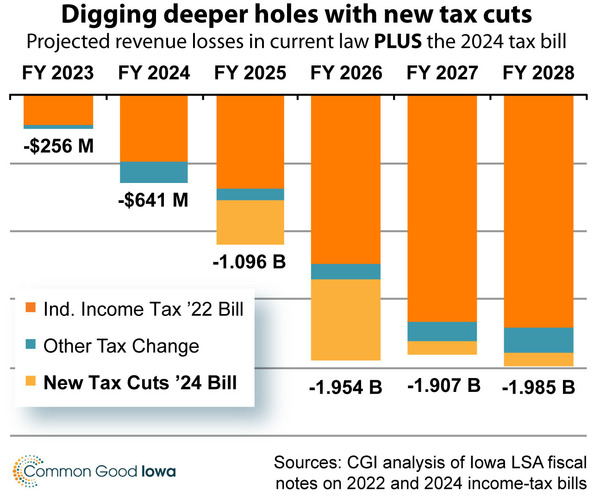

In Iowa, references by media and politicians to new tax cuts often understate the impact on services. While they note, accurately, that the latest tax bill cuts revenue by about $1 billion over three years,[1] they often miss the bigger picture.

In short, in FY 2026 Iowa revenues will be about $2 billion below what they would have been if not for tax cuts passed in 2022 and 2024 – equivalent to over 20% of the $8.9 billion state budget passed this year.[2] That $2 billion reduction already was in sight; now we’ll get there faster as the graph below shows.[3]

The 2024 bill merely finished the job started in 2022, as the tax-cut package signed May 1 by Governor Kim Reynolds deepened and accelerated cuts already in place. Instead of phasing in a 3.9% flat-rate income tax in tax year 2026, we’ll have a 3.8% rate in tax year 2025.[4]

Both plans overwhelmingly benefit the wealthiest Iowans. The latest one gives only 14% of the tax benefits to 65% of tax filers in the first tax year.[5]

For budget purposes, the biggest additional hit will come in FY 2026 – $605.6 million – the first full fiscal year under the 3.8% flat-rate income tax.

The official projected loss of revenue in FY 2026 is projected to hit $1.95 billion – two years earlier than anticipated under the previous bill.

For now we can all listen to the governor and her legislative allies and pretend it doesn't matter because we’re piling up surpluses – $2.4 billion in the coming year.[6] (There’s that $2 billion figure again!) We have stashed money away as the economy, boosted by federal aid, has kept revenues flowing – all while lawmakers have chronically underfunded investments in Iowa and its future.

By any responsible analysis, the implications are severe for Iowa to sustain public services expected by its residents – let alone to enhance them.

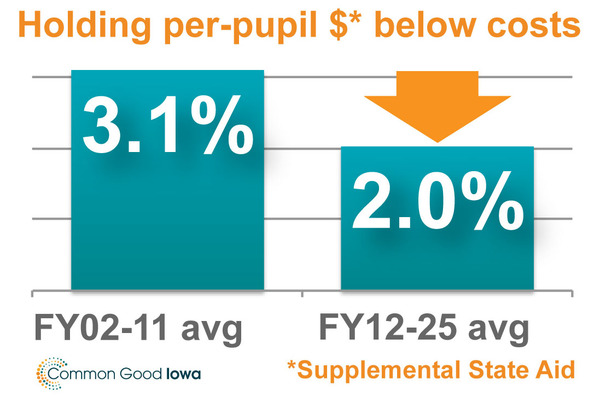

But the cuts do matter. Even without the impact of the recent cuts, Iowa has held per-pupil education spending growth at 2% on average for 14 years.

But the cuts do matter. Even without the impact of the recent cuts, Iowa has held per-pupil education spending growth at 2% on average for 14 years.

That doesn’t keep up. Schools already are announcing new cuts due to the funding issues, not just from low state support but the additional pressure caused by funding a second – and unaccountable – school system through private-school vouchers.[7]

Education is the biggest part of the budget, and while it’s being hit, it’s by far not the only example of meager support even before the new tax cuts take their toll, when surpluses fade and one-time reserves are tapped. State parks are another example – they cannot be maintained adequately because of underfunding.[8]

Common sense tells you it will only get worse.

Mike Owen is deputy director of Common Good Iowa. Contact: mowen@commongoodiowa.org.

Categories: Budget & taxes