American Rescue Plan tax credit will boost families

Posted on April 16, 2021 at 2:12 PM by Peter Fisher

By now, many of us have seen the first of many benefits of the latest COVID-19 relief bill — funds deposited in our bank accounts. The American Rescue Plan (ARP) authorized the payment of $1,400 per person for every adult and child in a household with income below the threshold: $75,000 for single adults, or $150,000 for a couple.

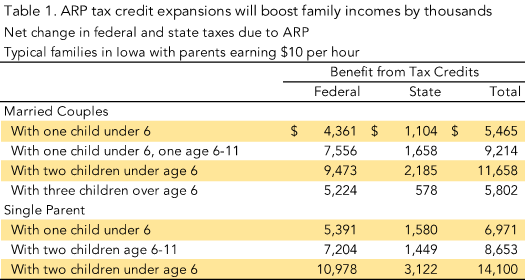

Much more is to come: assistance in paying rent and utilities; help covering the cost of food, health insurance, and child care; the extension of much-needed unemployment benefits. Altogether, about $960 billion in assistance to Americans represents over half of the total cost of the ARP legislation. The bill also expands important tax credits that will put as much as $12,000 or $14,000 in additional funds in the pockets of an Iowa family, and will benefit an estimated 93 percent of Iowa’s children as well as 181,000 low-wage workers without children.1

All this help comes at a time when millions of Americans are still reeling from the effects of the COVID recession. Recovery has stalled in recent months; there are still 80,400 fewer jobs in Iowa than just before the pandemic. Thousands of Iowans have dropped out of the labor force in the past year and are no longer counted among the unemployed. The Iowa labor force has shrunk by nearly 100,000 since February of 2020.2 Those unemployed or forced out of the labor market are disproportionately women and persons of color. Women represented 41 percent of the unemployed in Iowa in 2019, 47 percent in 2020.3

Credits provide a large boost to incomes in 2021

Two credits for families with children are raised dramatically for 2021 by the ARP. One is the Child Tax Credit (CTC), which is available to all families with children under age 17. The other is the Child and Dependent Care Credit (CDCC), which covers a portion of the cost of care for children and other dependents. The increase in the federal CDCC will automatically result in a larger state CDCC. The Child Tax Credit increase alone will benefit an estimated 669,000 Iowa children — 93 percent of the children under age 18 in the state — and will lift an estimated 25,000 Iowa children above the poverty line.4

In the table below we show the combined benefits of the ARP changes in the CDC and the CDCC for seven Iowa families with children of different ages and different childcare needs and with all adults working full time at $10 per hour.

Earned Income Tax Credit helps childless workers

A third major tax credit change involves the Earned Income Tax Credit (EITC). The federal EITC provides substantial help to lower wage workers raising children. But single or married childless workers received a much smaller credit. Under the ARP, this lower “childless EITC” is nearly tripled to reflect the devastating effects of the recession on low wage workers, whether raising a family or not. The maximum credit is raised from $543 to $1,502 and the income ceiling for receiving some benefit is raised from $15,980 to $21,430.

The Iowa EITC is simply 15 percent of the federal. As a result of ARP, low-wage childless individuals and couples will thus automatically receive a higher state EITC. A single person working full time at minimum wage would receive an additional $902 in federal EITC and then another $125 from the state credit as a result of ARP.

_________________________

1 Center on Budget and Policy Priorities. American Rescue Plan Act Will Help Millions and Bolster the Economy. March 10, 2021.

2 Iowa Workforce Development, Press Release, March 26, 2021.

3 U.S. Bureau of Labor Statistics, Expanded State Employment Status Demographic Data. https://www.bls.gov/lau/ex14tables.htm

4 Center on Budget and Policy Priorities. American Rescue Plan Act Will Help Millions and Bolster the Economy. March 10, 2021.

Categories: Family support & well-being