Ingredients of Iowa's recipe for budget disaster

Posted on January 26, 2024 at 9:40 PM by Mike Owen

(This blog is drawn from messages in a presentation by CGI Deputy Director Mike Owen for an Interfaith Alliance of Iowa event Jan. 19. Find a PDF excerpting the presentation slides here, and a video here.)

In 2022 as legislators and the Governor prepared to propose big tax cuts, on top of cuts approved in 2018 and 2021, Common Good Iowa called it a "recipe for disaster." CGI was right then, and Governor Kim Reynolds' new proposed cuts will make it worse.

The math is clear. Iowa's own state fiscal experts have shown it in many ways, most notably the official fiscal note for the 2022 tax bill that projected a loss of $1.8 billion in FY 2027 and $1.9 billion in FY 2028 when the 3.9% flat-rate income tax is fully phased in. Though the official estimates aren't out, Governor Reynolds would knock out those kinds of losses beginning this year, retroactive to Jan. 1, as she proposes a lower flat rate, to 3.65% this year and 3.5% next year.

You can see the impact in the sharply reduced surpluses she expects if her tax plan passes — $973 million for FY 2025, compared with $1.8 billion for the current budget year ending June 30. (p. 69, Governor's Budget in Brief). As long as the strong national economy and temporary federal aid to Iowa keep Iowa's revenues stronger than they might otherwise be, those cuts can be covered. But when the aid goes away and the economy ultimately finds a rough patch, Iowa will be under water. The tax cuts will hold it down.

Again, that's just math. And that's just on the side of lost resources to meet Iowa's commitments and expectations for strong public education, access to health care, clean water and safe streets.

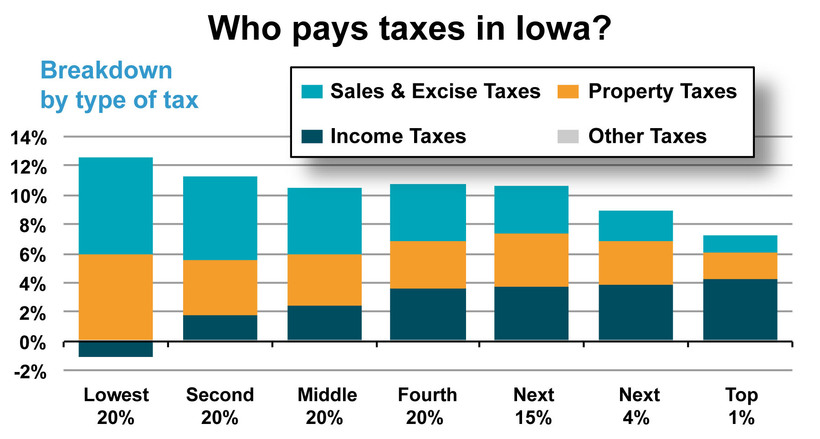

But there's another angle: fairness. It has been evident for many years that Iowa — like many states — has what economists call a "regressive" tax system. That is, people at lower incomes pay a greater proportion of their income in state and local tax than do people at higher incomes. The latest "Who Pays?" report from the Institute on Taxation and Economic Policy illustrates that inequity.

That graph shows the overall impact. The ITEP analysis also illustrates the role of the income tax as the only state and local tax that countered the regressive nature of sales and property taxes.

It's going to become much worse as the 2022 tax cuts phase in, because they severely cut the income tax, benefiting high-income people. Those dark parts of the bars will shrink, causing a steeper decline in the overall tax rates from the bottom to the top of the income scale.

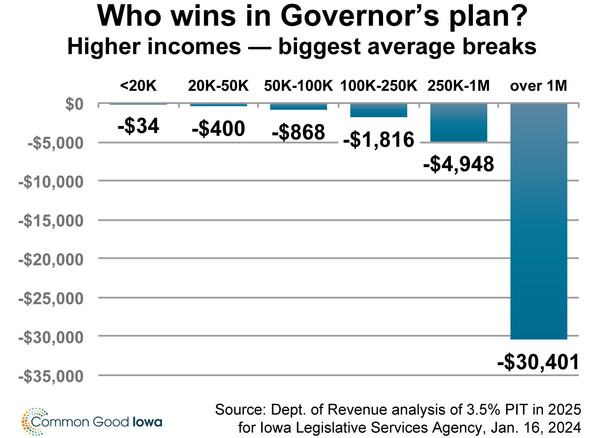

And, it's going to become even worse if Governor Reynolds' plan (or something like it) passes in this legislative session. ITEP has crunched the numbers — and so has the Iowa Department of Revenue (DOR). ITEP found 63 percent of the benefit goes to people in the top 20 percent of income. The DOR analysis shows how much millionaires benefit with a cut to a 3.5% income tax compared to middle- and low-income Iowans.

A "recipe for disaster"? By any measure. For a better result, combine the ingredients above, fold in the math evenhandedly and put in the oven to produce revenue that meets our needs and is raised fairly. Make sure nothing is half-baked. Add a pinch of common sense. There is still time to get this right.

Categories: Budget & taxes, Clean air & water, Family support & well-being, Health, Higher education, PK-12 schools, Public Safety