Missing opportunity on tax reform

Posted on March 20, 2024 at 12:52 PM by Mike Owen

Iowa lawmakers are missing a great opportunity.

They could be meeting right now on legislation to restore the equity we already have lost in our tax system. Instead, proposals being considered would make it worse.

One example is Senate Joint Resolution 2004 — passed Wednesday morning in subcommittee and the full Ways and Means Committee in the afternoon. That bill would enshrine unfair taxation in Iowa’s constitution. Its only beneficiaries are people at high incomes.

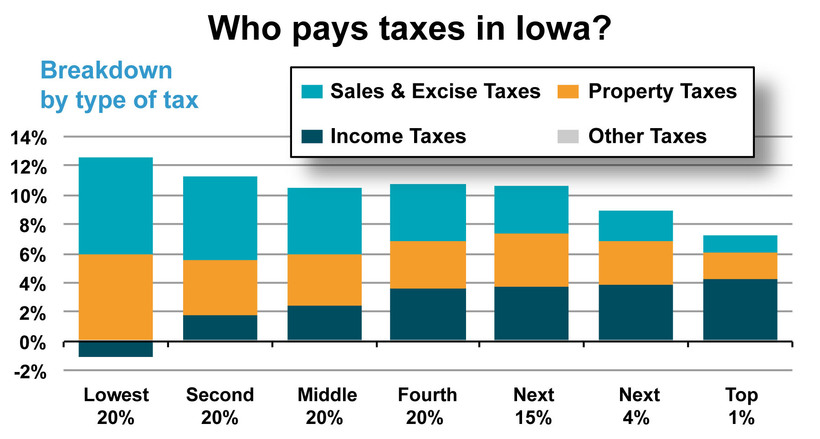

Proponents can’t offer any math to support this. We have the math that shows its failings. We’ve shown repeatedly over the last 20 years that our total state and local tax system takes a greater proportion of income from lower-income Iowans than from those at high incomes. In other words, it’s not based on the ability to pay — but rather, on who has the power to make the rules that support them.

The latest analysis, from the Institute on Taxation and Economic Policy, illustrates the inequity in the current system.

Breaking it down by type of tax, you can see the only part of the system that addresses part of the imbalance is — what has been — a progressive income tax, with graduated rates. Those are the dark sections of each bar. Reduce or take that part away, and you can see how much steeper will be the tilt favoring high-income Iowans while our resources decline.

A single-rate, or flat-rate, income tax will make these pictures worse. If you think a flatter system is the way to go, this goes the opposite direction. A flat-rate income tax will throw the overall system further out of balance.

Proposals like SJR 2004 are merely a ruse. They fly a false banner of their impact, masking both the fundamental unfairness in our current system with a scheme that compounds the damage. They rig the game to further favor the rich.

Think of it this way: Let’s say we get a 3.5% flat-rate income tax, as Governor Reynolds proposes. Common sense tells you 3.5% makes far more difference to a working family making $40,000 than it does to a household making $140,000, or $240,000, or $1 million. It’s the difference between meeting many basic needs for the family at $40,000, while at progressively higher incomes it’s not touching those needs at all.

Take it a step further: A “flat rate” isn’t a flat tax on income. It’s applied to income determined to be “taxable.” And at higher incomes, the tax breaks are many — and no end to new ones are in sight. That means the 3.5% rate that might apply to all or most of a low- or middle-income family’s income may only apply to a small portion of a high-income family’s income. And that means the higher-income family isn’t paying 3.5%, but potentially something far less.

Take it one more step, and address the elephant in the room: the impact on services that Iowans count on to make the state a good place to live, work and raise a family. These proposals all result in fewer resources for those purposes. Once again, lawmakers are talking about taxes in a vacuum, ignoring that impact — because that is where the hard choices are made.

Iowa’s tax system needs serious reform, and with few exceptions the changes passed in 2018, 2021 and 2022 compound the damage. At the very least it’s time to take a breath and see where the 2022 changes take us before implementing any new broad income-tax cuts.

We should keep options open for legislators elected to fix the inevitable mess. The very last place we should be messing around is the state constitution.

Categories: Budget & taxes